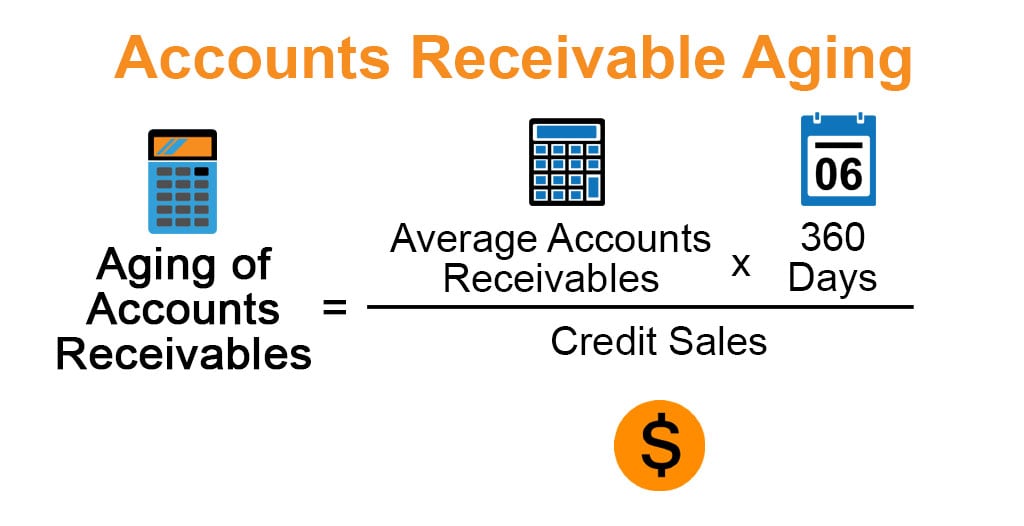

Whether its to pass that big test qualify for that big promotion or even master that cooking technique. Use the balance sheets of the current year and the previous year to calculate the average gross receivables.

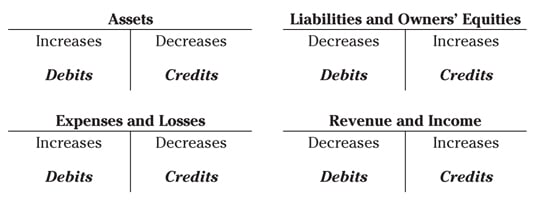

T Accounts A Guide To Understanding T Accounts With Examples

T Accounts A Guide To Understanding T Accounts With Examples

Accounts receivables are the money owed to the company by the customers and accrual accounting system allows such type of credit sales transactions by opening a new account called accounts receivable journal entry Accounts receivables can be considered as an investment made by the business that includes both risks and returns.

Accounts receivable for dummies. The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. Accounting ALL-IN-ONE by Ken Boyd Lita Epstein Mark P. Account Receivable is an account created by a company to record the journal entry of credit sales of goods and services for which the amount has not yet been received by the company.

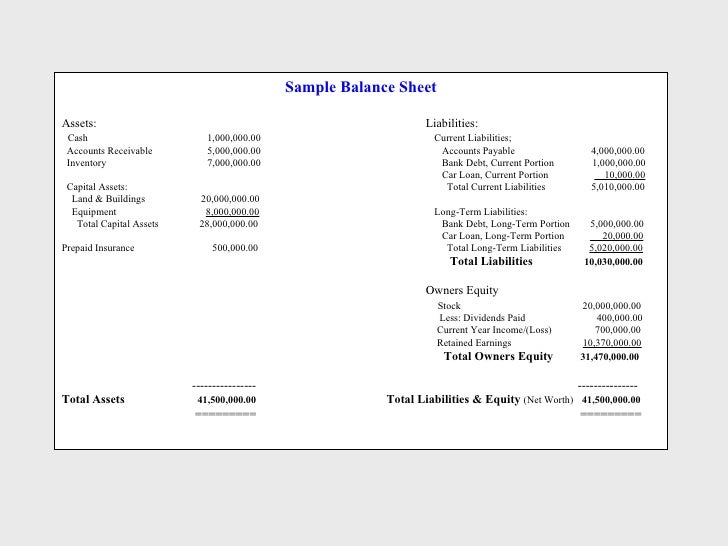

Accounts receivable AR is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivables are listed on the balance sheet as a. The 6 best ways to increase your accounts receivable turnover ratio.

Unfortunately for various reasons some accounts receivable will remain unpaid and will need to be provided for in the accounting records of the business. Accounts payable includes money a company owes it vendors for services and products that it has purchased in the normal course of business and anticipates paying back in the short term. To achieve a modified basis system track your cash reconcile your bank accounts and credit accounts invoice your clients accounts receivable discussed here and document what you owe accounts payable.

Accounts Receivable are usually short-term assets that are turned into cash from the date of the sales transaction. Accounts receivable asset accounts allow a businesss customers to buy on credit. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative.

Any accounts receivable involve three important facts. Accounts receivable represent amounts due from customers as a result of credit sales. Recognition valuation and disposition.

The official record of the account receivable delivered to the customer is a sales invoice. The Receivable Processor DRS has the same rights as other agency Receivable Processors. So as to manage the operating activities of the organizations in efficient and effective manner.

An Accounts Receivable record typically specifies terms. Dummies helps everyone be more knowledgeable and confident in applying what they know. In most cases your business doesnt collect all its receivables by the end of the year especially for credit sales that occur in the last weeks of the year.

For example the company may purchase inventory from a manufacturer or may buy office supplies from a local supply retail shop. Holtzman Frimette Kass-Shraibman Maire Loughran Vijay S. It handles invoicing and credit notes accounts payable and receivable employee expenses and some payroll features too and its quite happy with multiple currencies cards and accounts.

People who rely on dummies rely on it to learn the critical skills and relevant information necessary for. Accounts receivable AR is the amount of money a customer owes the business for merchandise it purchases from a company or services a company renders. Take initial deposits at the start of a project Regularly audit your balance sheet.

Just about all types of businesses can and probably do have accounts receivable. For a fuller explanation of journal entries view our examples section. Accounts Receivables are accounted in the asset book of the seller as the buyer owes him a sum of money against the goods and services already rendered by the seller.

Accounts Receivable Process includes process of collecting money setting up policies and procedures deciding the credit period maintaining the detailed records of each process deciding on discounting of receivables decision about extending the process etc. In this session I explain accounts receivable. Accounts receivable is covered in financial accounting and CPA exam.

Use your digital calendar to set reminders on payments Be proactive in your invoicing practices Provide discounts. Improve your billing efficiency. Dummies has always stood for taking on complex concepts and making them easy to understand.

Tracy and Jill Gilbert Welytok. Add the accounts receivables from both years and divide that number by 2. They are also responsible for Item Maintenance.

An Account Receivable is a legally enforceable claim for payment to a customer for a good or service which was fulfilled or shipped. Typical Accounts Receivable Journal Entries. The Receivable Processor Manual has the same rights as other agency Receivable Processors.

Divide net sales by the answer from Step 2 to get the accounts receivables turnover. Accounts receivable AR is the balance.

Accounts Payable Explanation Accountingcoach

Accounts Payable Explanation Accountingcoach

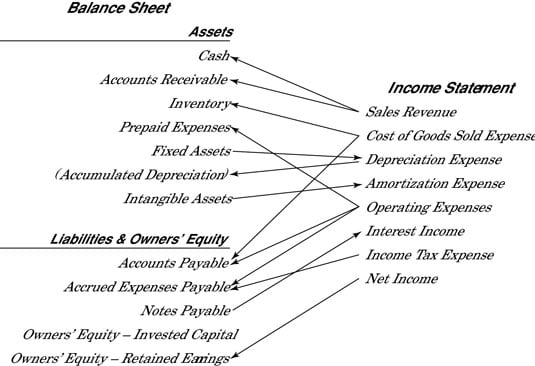

Connecting The Income Statement And Balance Sheet Dummies

Connecting The Income Statement And Balance Sheet Dummies

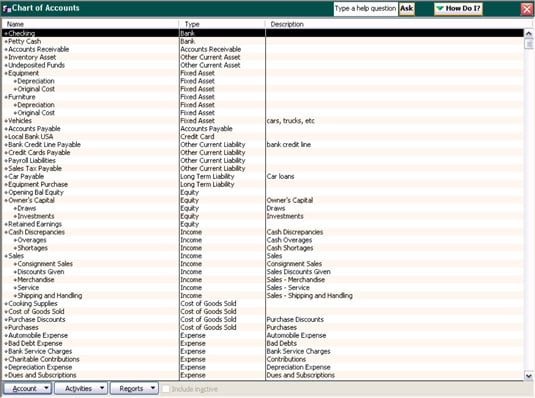

How To Set Up A Chart Of Accounts For Bookkeeping Dummies

How To Set Up A Chart Of Accounts For Bookkeeping Dummies

What Is Accounts Receivable Accounting For Money Owed To You

What Is Accounts Receivable Accounting For Money Owed To You

/bookkeeping-101-a-beginning-tutorial-392961_FINAL2-c41c8a80cb744b85b2e85192c4defc1d.png) A Beginner S Tutorial To Bookkeeping

A Beginner S Tutorial To Bookkeeping

Sap Accounts Recievables Sap Simple Docs

Sap Accounts Recievables Sap Simple Docs

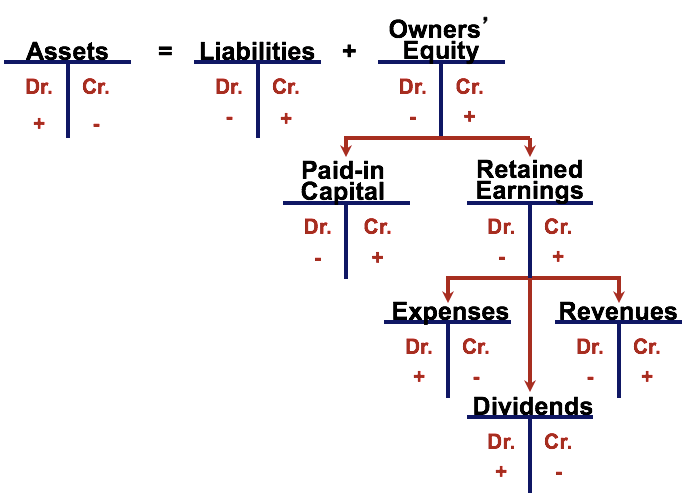

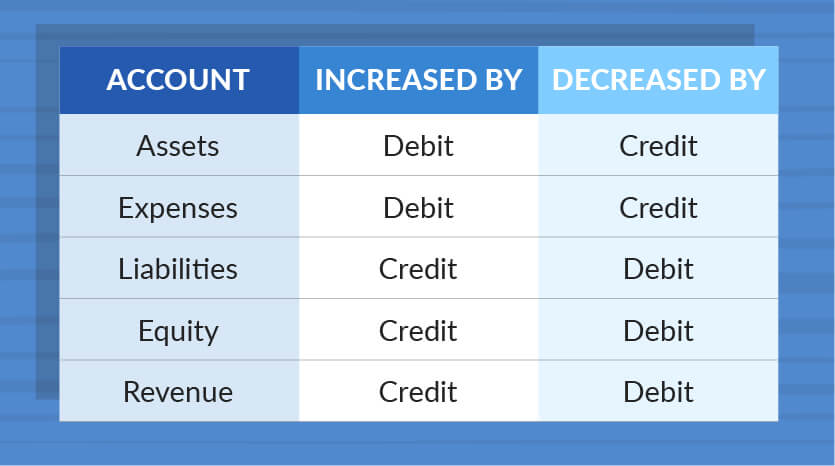

Accounting Workbook For Dummies Cheat Sheet Dummies

Accounting Workbook For Dummies Cheat Sheet Dummies

Accounts Receivable Aging How To Calculate Accounts Receivable Aging

Accounts Receivable Aging How To Calculate Accounts Receivable Aging

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png) Accounts Receivable On The Balance Sheet

Accounts Receivable On The Balance Sheet

Receivables Performance Management On Choosing An Accounts Receivables Management Company

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg) Working Capital Nwc Definition

Working Capital Nwc Definition

The Difference Between Accounts Payable Vs Accounts Receivable

The Difference Between Accounts Payable Vs Accounts Receivable

-

Digital Audio Output As their name implies the analog audio output transmits analog audio signalwhile the digital audio output transmits dig...

-

Past Participles are forms of verbs that express a completed action. Translate become in context with examples of use and definition. Past...

-

Weve tabbed out this guitar scales chart for you below. A Minor Scale Lessons - Scales. Pentatonic Minor Scale Guitar Patterns Chart Key O...

it's a good life pdf

It's a Good Life PDF Free Download . It's a Good Life. IT’S A GOOD LIFE By JEROME BIXBY Aunt Amy was out on the front porch, r...