Accrual accounting therefore is not concerned with when payments were received or made. Under accrual basis this company is showing sales at 87k and profit at 82K.

Accrual Vs Cash Basis Accounting Youtube

Accrual Vs Cash Basis Accounting Youtube

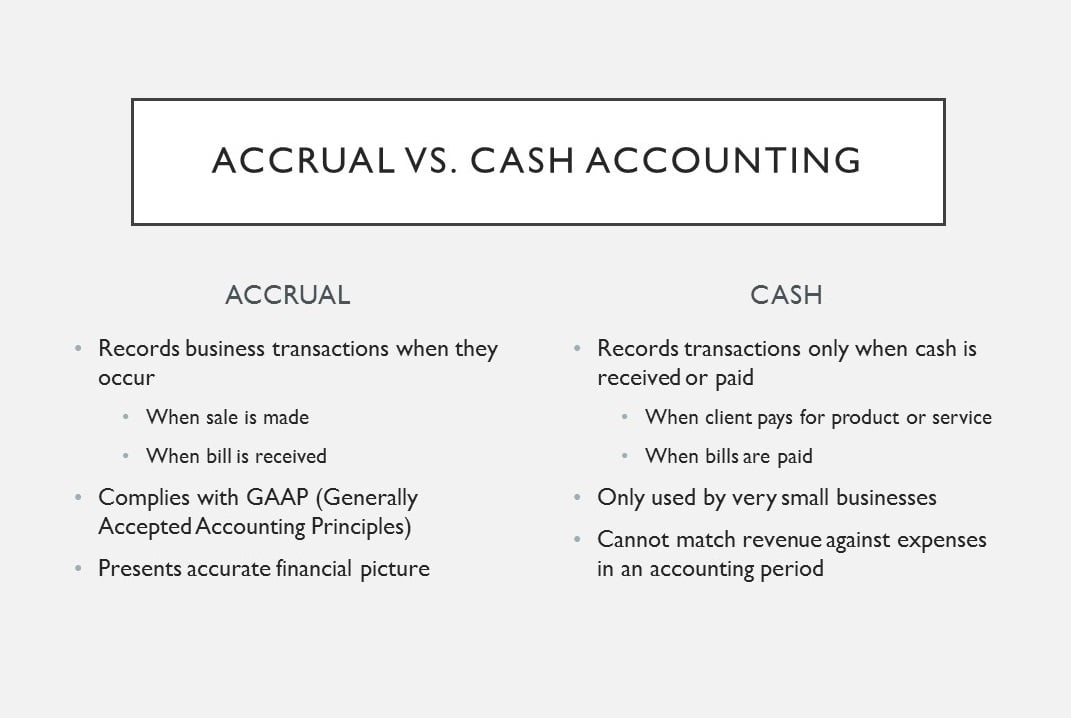

While the accrual basis of accounting provides a better long-term view of your finances the cash method gives you a better picture of the funds in your bank account.

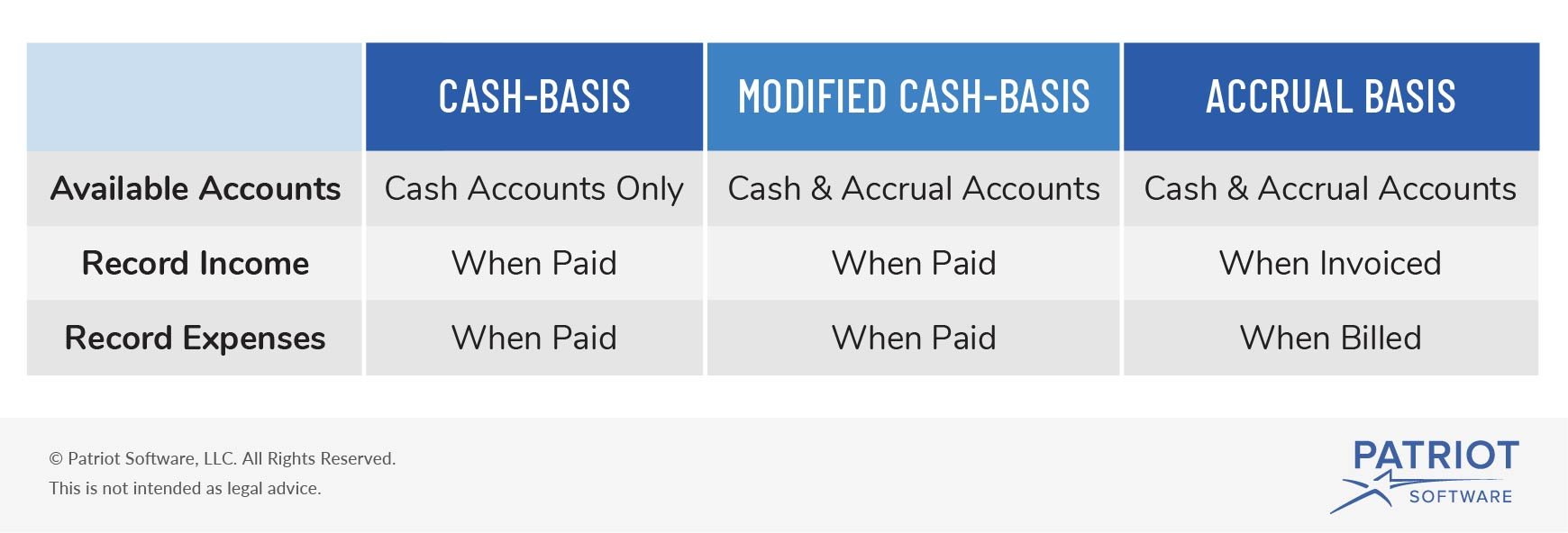

Accrual vs cash basis. The cash method is a more immediate recognition of revenue and. Accrual Basis Accounting vs. Using cash basis accounting income is recorded when you receive it whereas with the accrual method income is recorded when you earn it.

Cash Basis is Cheaper-The only downside to accrual basis is its cost to maintain. Accrual accounting is a far more powerful tool for managing a business but cash accounting has its uses. If you run a small business cash.

The difference between an accrual vs a cash basis method has ramifications on how you report on your business performance which every business owner should be aware of. Moving to a cash basis will reduce the need for accounting adjustments and will simplify the recording of transactions. Tax Law Changes and Accounting Options The 2017 Tax Cuts and Jobs Act allowed for a change in the option to select cash accounting instead of accrual.

Small businesses often dont want to pay monthly accounting fees for accrual basis bookkeeping. Accounting professionals such as CPAs. By contrast the accruals basis which is the current standard takes account of income earned and expenses incurred in the accounting period regardless of whether the associated cash has actually been received or paid out.

This is because the accrual method accounts for money thats yet to come in. To illustrate the difference between the two accounting methods take the example where a business sells a product and the customer pays by credit. Key Differences Between Cash Basis and Accrual Basis of Accounting We have looked at the basic features advantages and disadvantages of both cash vs accrual accounting.

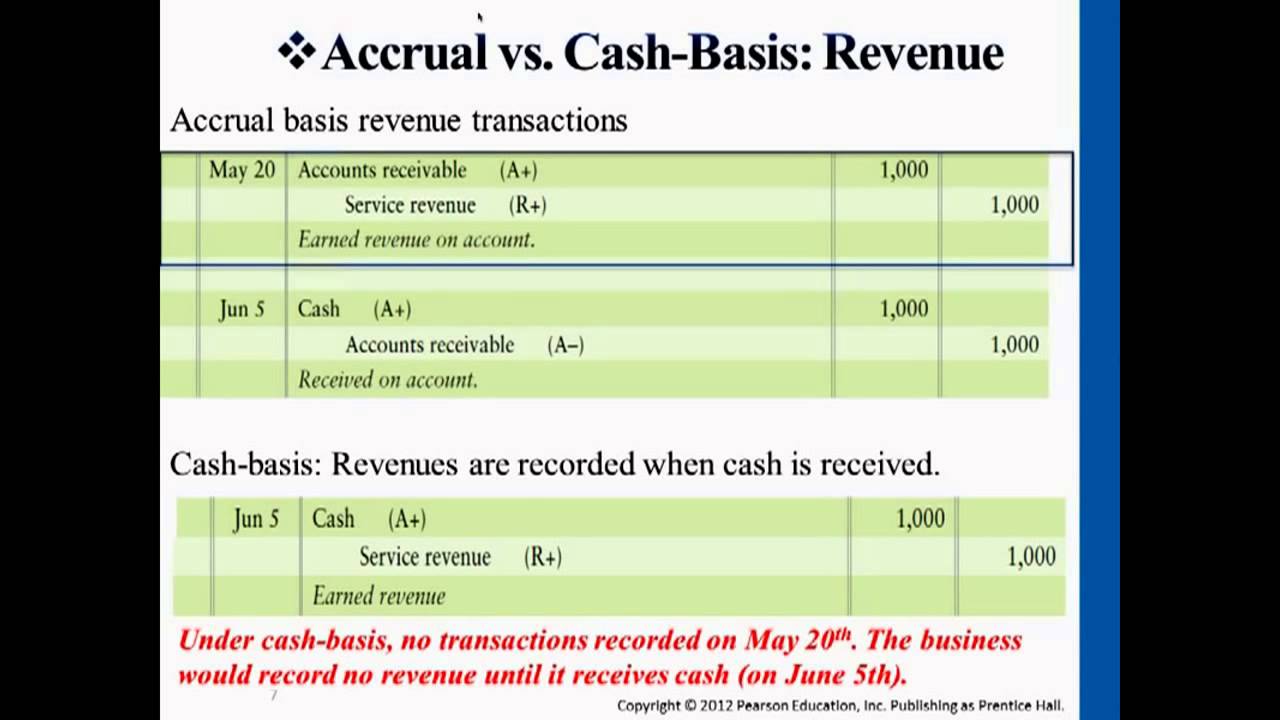

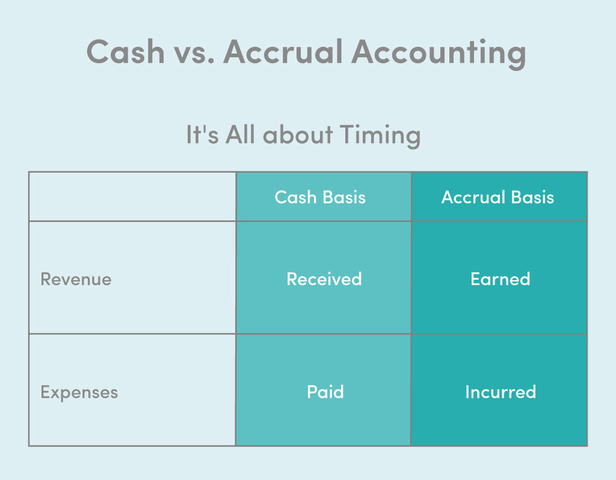

The main difference between accrual and cash basis accounting lies in the timing of when revenue and expenses are recognized. The difference between the two types of accounting is when revenues and expenses are recorded. Now depending on the method chosen this directly impacts your tax filings and taxes owed.

Cash Basis Accounting Micah Fraim - June 1 2019 Select rating Give it 055 Give it 15 Give it 155 Give it 25 Give it 255 Give it 35 Give it 355 Give it 45 Give it 455 Give it 55. Under cash basis this same company during the same period is showing sales at 16k and profit at about 14k. Cash basis is a way to work out your income and expenses for your Self Assessment tax return if youre a sole trader or partner.

Why use cash basis. These methods are simply two different ways to record your business transactions. Cash Vs Accrual Accounting.

It is time to compare both to understand which one would be more suitable for your organization. When aggregated over time the results of the two methods are approximately the same. A brief description of each method follows.

Cash basis accounting is easy to use because you only have to keep track of money that goes in and comes out of your bank account. Cash basis accounting is simpler to use and costs less than an accrual accounting system. In the early stages of a small business cash-basis accounting is often the go-to method of keeping the books whereas more complex or larger businesses with 1 million or more in annual revenue use the accrual basis.

The decision to use cash or accrual accounting has a big effect on your business tax return and ultimately your bottom line. What is cash basis accounting. However cash basis is often more expensive in the long run due to delayed cleanup expense or trouble during due diligence when trying to sell the business.

If you do it when you pay or receive money its cash basis accounting. Cash Basis vs Accrual Accounting The main difference between cash basis and accrual accounting is the specific timing of when revenue and expenses are recognized on your business PL. The core underlying difference between the two methods is in the timing of transaction recordation.

The cash basis and accrual basis of accounting are two different methods used to record accounting transactions. Because of its low cost cash-based accounting is popular with sole proprietorships and partnerships. One of the differences between cash and accrual accounting is that they affect which tax year income and expenses are recorded in.

In cash basis accounting revenue is recorded when cash is received and expenses are recorded when they are paid regardless of when they were invoiced. Accrual Accounting Unlike cash accounting with accrual accounting you must calculate your VAT on the basis of when the invoice was received in the case of clients or issued in the case of suppliers. If you do it when you get a bill or raise an invoice its accrual basis accounting.

The accrual accounting method is more complex than cash basis accounting making it a much better fit for businesses with an experienced bookkeeper on staff. The cash basis method immediately recognizes revenue and expenses while the accrual method records when the revenue and expenses occur even if the cash hasnt actually exchanged hands.

Cash Vs Accrual The Difference Between Cash Accrual Accounting

Cash Vs Accrual The Difference Between Cash Accrual Accounting

Cash Vs Accrual Accounting What Is The Difference Enkel

Cash Vs Accrual Accounting What Is The Difference Enkel

Why Cash Vs Accrual Accounting Matters For Your Business

Why Cash Vs Accrual Accounting Matters For Your Business

Accounting Methods Cash Basis Accounting Vs Accrual Accounting

Accounting Methods Cash Basis Accounting Vs Accrual Accounting

Cash Vs Accrual Accounting Double Entry Bookkeeping

Cash Vs Accrual Accounting Double Entry Bookkeeping

Cash Vs Accrual Accounting In Financial Projections Plan Projections

Cash Vs Accrual Accounting In Financial Projections Plan Projections

What Is A Cash Basis Income Statement Quora

What Is A Cash Basis Income Statement Quora

3 1 Accrual Vs Cash Basis Accounting Youtube

3 1 Accrual Vs Cash Basis Accounting Youtube

Cash Vs Accrual Basis Accounting For Small Businesses Financepal

Cash Vs Accrual Basis Accounting For Small Businesses Financepal

Cash Vs Accrual The Difference Between Cash Accrual Accounting

Cash Vs Accrual The Difference Between Cash Accrual Accounting

Https Fas Org Sgp Crs Misc R43811 Pdf

Cash Basis Vs Accrual Comparing Accounting Methods

Cash Basis Vs Accrual Comparing Accounting Methods

Living Stingy Cash Or Accrual Basis

Living Stingy Cash Or Accrual Basis

Cash Basis Accounting Vs Accrual Accounting Bench Accounting

Cash Basis Accounting Vs Accrual Accounting Bench Accounting

-

Digital Audio Output As their name implies the analog audio output transmits analog audio signalwhile the digital audio output transmits dig...

-

Past Participles are forms of verbs that express a completed action. Translate become in context with examples of use and definition. Past...

-

Weve tabbed out this guitar scales chart for you below. A Minor Scale Lessons - Scales. Pentatonic Minor Scale Guitar Patterns Chart Key O...

it's a good life pdf

It's a Good Life PDF Free Download . It's a Good Life. IT’S A GOOD LIFE By JEROME BIXBY Aunt Amy was out on the front porch, r...